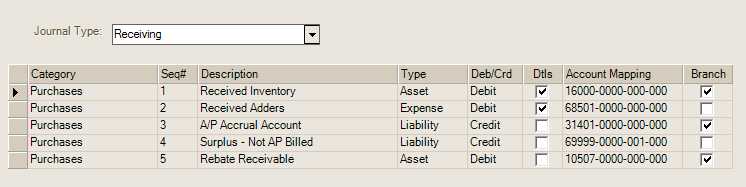

Receiving Mapping

Receiving mapping is used for purchases (receipts) of inventory.* An A/P (accounts payable) accrual account is used for holding the balance of inventory purchases that have not been billed in Accounts Payable. When billing is done, the accrual account is reduced (debited) and the general Accounts Payable liability account is credited (increased). General ledger entries that move funds from the accrual account to accounts payable are defined in the Accounts Payable system journal.

1.Received Inventory (Asset): This account balance is increased (debited) when your company's inventory increases due to an inventory purchase. Detailed mapping by product group for Inventory Purchases is available and will be used if set up for inventory within a mapped product group. Otherwise, the default account listed here will be used (when no detailed mapping exists for the product group being received).

2.Received Adders (Expense): Receipts of inventory may included adjustments for expenses such as freight charges, etc. Each Adjustment Code (used for purchasing) can be linked with a specific expense account. If this is done, that account will be used instead of the account mapped here. Otherwise, if no specific expense account is assigned to the adjustment code, the account mapped here is used as a default. Most purchase adders are expenses, so the default entry is a debit that increases the balance of an expense account; however, adjustments can potentially either increase or decrease the cost of goods being received. This means that it's possible for adjustment codes to be mapped to a different account type or instead to produce a negative debit to the default expense account listed here.

3.A/P Accrual Account: This holding account retains a balance representing purchases of inventory that have not yet been billed (invoiced in Accounts Payable). The actual entries that move purchase amounts from the accrual account to the general Accounts Payable (A/P) liability account happens when an A/P invoice is either paid or designated for transfer to General Ledger and an End of Day process is completed (this creates journal entries). The accrual account is a consolidated account. No branch entries are generated.

4.Surplus - Not AP Billed: This account represents the amount of Receiving Adjustments that were designated as "Do Not AP Bill." These adjustments affect the cost of the goods being received but are not passed through to Accounts Payable.

5.Rebate Receivable: This entry is provided for use with the Rebate Tracking feature and represents the balance of expected vendor rebates. Vendor Rebates are used in situations where a company initially purchases goods at a higher cost then is later reimbursed a portion of that cost as a "rebate" after paying the vendor's invoice. It is possible, and typical when using this feature, that the initial cost of the received goods be adjusted to anticipate the expected rebate. The rebate usually represents your company's margin (aka. profit) in this case. This account provides a second offset to the accrual account coinciding with the usual entry to asset inventory. The inventory asset entry is "adjusted" by the expected rebate in order to more accurately anticipate the "true" cost of what was purchased. By using this account as an offset to the accrual, the accrual account can remain as the full amount received which then should match the receipt and vendor invoice. This helps maintain the balance between open (not billed) inventory receipts and the ledger's accrual balance.

This account will also be the default offset used for any Vendor Rebate check payments (entered via Point of Sale, Payments) as well as vendor credit invoices for rebate credits (entered through Billing Entry in Payables).

*The Receiving system journal can also be affected by any merging of items that involves the movement of inventory value from one item to another. For example, if item ABC is merged into item XYZ, any on-hand for ABC is moved to XYZ and XYZ's weighted average is re-calculated. This is done by an application generated receipt adjustment. In this case, an entry is created in the Receiving Journal and the Inventory Journal. The A/P Accrual account from the Receiving mapping is used as an offsetting "wash" entry in both journals.