PS Folders > Customer

The "customer" folder displays information related to the current customer's account and jobs. There are 4 sub-level tabs in the customer folder: account, job, balances, and open docs (documents).

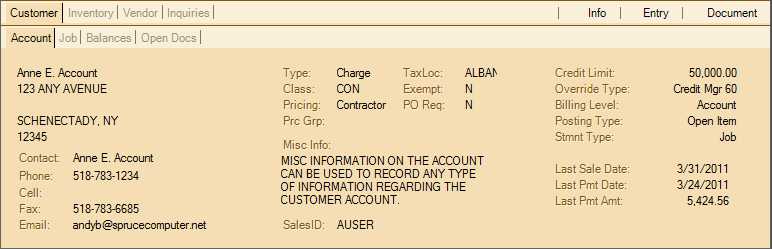

Account

Account displays overall account information (not job specific) and information regarding the customer's primary contact.

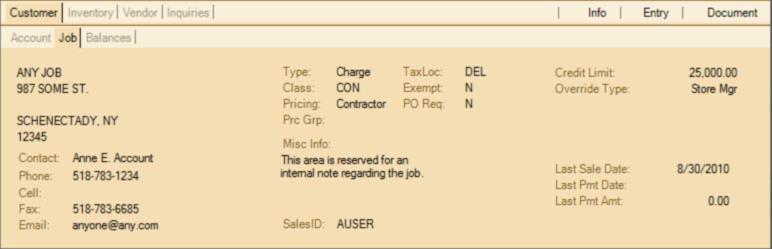

Job

The "job" tab lists information specific to the particular job ifone is in use (optional). When jobs aren't set up for the customer, most of the information displayed will match the "account" tab. Jobs may be added to an account by using the Job Maintenance form or on the process form for the transaction (F12).

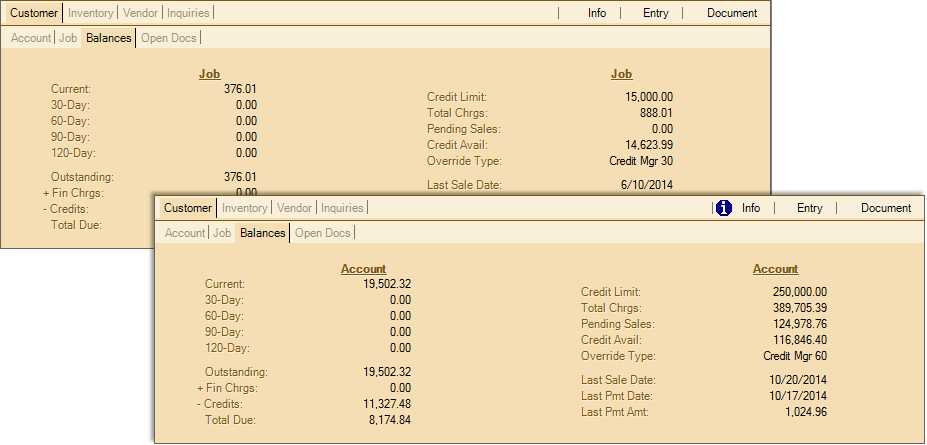

Balances

The "balances" tab lists the customer's receivables (charge) balances as well as information about their credit limit, total charges (since the account was established), amount of current outstanding orders, and credit available. Total charges is not included in any of these calculations and is provided solely for reference. The information shown will vary based on the billing level of the selected account. For accounts with a billing level of "job," the balances and related information for the selected job are shown. For accounts assigned a billing level of "account" (consolidated), balances and other information are for the entire account (even if a job is selected).

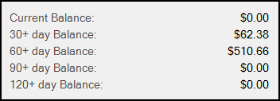

Aged Balances

Each month, you run an automated billing process that ages account and job balances. This is only done once a month on the day designated by your company... never on a daily basis. At this time, each balance is moved into the next older period's total. There are a total of five aging totals maintained for each account and, in some cases, for jobs. Job balances and aging are only maintained when the job's account has a billing level of "job." For accounts with a receivable's type of "open item," invoices aren't aged themselves; however, the age of items can be determined based on the billing cycle number that was assigned to each sale at the time it was processed. The billing cycle number is incremented by each month (on the billing date).

The application adds finance charges to any "past due" (not current) balance remaining unpaid at the time finance charges are assessed. Payment processing and aging of balances (as well as open items) depends on the "posting" process which can be done manually or automatically. Automated billing will process a "global" application of unapplied credits (posting) when it processes; however, this only applies payment and other credits to balance forward accounts except in cases where an "open item" account's total due plus finance charges and less any eligible discount equals the total credit balance exactly at time of billing. New finance charges are not assessed on "Closed" accounts even if they maintain past due balances.

Note: You can find definitions for terms such as Grace Period, Check Clear Days, and Finance Charge % in the Parameters > Receivables topic. For more about billing levels and POS Default Invoice Terms (Open Item Terms account settings), see the Account Maintenance Receivables topic.

Current Balance (New)

The current balance reflects an account's "new" charges (sales and debit adjustments) since the last billing period closed. This could also be described as the "non-billed" balance since the customer would not have received a bill for this amount yet. When the monthly automated billing process completes, this balance is moved to the first (1st) of four past due periods (described below as "30+ day Balance"). Charges reflected by this balance may be anywhere between zero and 30 days old.

30+ day Balance (Past Due #1)

This is the first "past due" or billed balance. This amount should be considered "current" until the payment due date has passed. Whether or not a account/job receives a discount if they paid this balance would be determined by the discount date in relation to when they pay their bill. The grace period and check clear days parameters can also have an effect on discount eligibility. When finance charges are assessed, if the account/job is assigned a finance charge percentage that is assessed on the "30+ Day balance" and this balance is greater than zero they would be assessed finance charges on this balance as well as any older balances. Charges reflected by this balance may actually be anywhere between one and 60 days old. It is referred to as "30+ Days" because any items making up the balance would typically not be billed until they are actually about 30 days old.

60+ day Balance (Past Due #2)

This is the second "past due" balance. This includes amounts that would have now appeared on two previous statements (bills) and typically would no longer be eligible for discounts if paid. When finance charges are assessed, if the account/job is assigned a finance charge percentage that is assessed on the "30+ Day balance" or "60+ Day Balance" and this balance is greater than zero, the billing process applies finance charges to this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be anywhere between 29 and 91 days old. It is referred to as "60+ Days" because the items making up the balance typically would not be billed until it they are about 60 days old.

90+ day Balance (Past Due #3)

This is the third "past due" balance. This includes amounts that would have now appeared on three previous statements (bills) and typically would no longer be eligible for discounts if paid. When finance charges are assessed, if the account/job is assigned a finance charge percentage that is assessed on the "30+ Day balance," "60+ Day Balance," or "90+ Day Balance" (see finance charge terms for the account) and this balance is greater than zero, they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be anywhere between 60 and 122 days old. It is referred to as "90+ Days" because the items making up the balance typically would not be billed until they are about 90 days old.

120+ day Balance (Past Due #4)

This is the fourth and final "past due" balance. This includes amounts that would have now appeared on four or more previous statements (bills) and typically would no longer be eligible for discounts if paid. No further aging is done on this balance. When finance charges are assessed, if the account/job is assigned any finance charge percentage and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be 90 days or older. It is referred to as "120+ Days" because the balance typically would not be billed until they are about 120 days old.

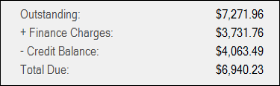

Balance Summary

A summary of balances, finance charges, and unapplied credits is listed along with the total owed (due) by the account (or job). Total due does not reflect any statement discounts.

Outstanding

This is the total of all aged balances including the current balance. It does not include finance charges, credit balances, or discounts. This total is maintained for the customer or job data and is not being directly calculated from the balances. Job balances are only maintained when the account linked with the job is assigned a billing level of job. This is always represented as a positive figure.

+ Finance Charges

The total of unpaid finance charges for the selected customer or job. Finance charges are only assessed by job when the account linked with the job is assigned a billing level of job. New finance charges are typically assessed with billing processing which is done on a monthly basis. Usually billing is done around the beginning or end of each month (last day of the month, or the 25th or first (1st), for example). Some companies have optionally elected to assess their finance charges mid-month (on a specific day of the month) instead. These finance charges are calculated on the designated date based on the customer's balances at that time; however, the finance charge won't appear in this total until the remainder of the billing process is completed. Finance charges are optional, and a number of settings and parameters affect if, how, and when finance charges are applied. This is always represented as a positive figure.

- Credit Balance

Credit balance is the total of unapplied (not posted) credits currently associated with the account. This total may be a combination of regular payments, credit memos (returns), and credit adjustments; however, it does not include discounts. This is always represented as a positive figure although it is deducted from the sum of the outstanding and finance charge totals.

Total Due

Total due is calculated from the outstanding, less any finance charges, and plus the credit balance. This is the total amount the customer currently owes not considering any discount or pending transactions (orders, tickets, etc. which have not yet been invoiced/processed). The total due may be a net credit amount (negative) if for some reason the unapplied credits exceed the sum of the outstanding balance and finance charges. In this case, the total due will be listed within parentheses. For example, "($14.92)" would indicate that the customer has an overall credit balance (negative total due).

Credit Limit

The dollar value assigned as the limit up to which the customer or job is allowed to purchase on credit. The limit can be overridden at Point of Sale by users with permission to do so.

Total Charges (Total Chrgs)

This is not the same as the total due, but is the total amount charged on the selected account or job since the account or job was established (added).

Pending Sales

Pending sales represents the account's customer order balance and includes any open tickets (aka. "advice notes" in the UK). The pending is considered when calculating a customer's available credit. This excludes any remaining deposits and includes sales tax and adjustments.

Available Credit (Credit Avail)

A customer's available credit is determined by taking the credit limit and subtracting the total due and amount of outstanding orders and open tickets (pending sales).

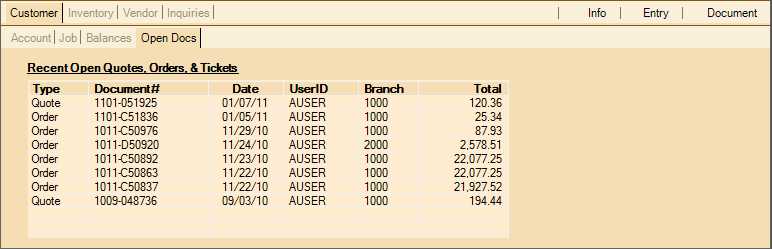

Open Docs

The Open Docs tab provides a short listing of the most recent open sales, quotes, orders, direct shipments, and tickets for the selected customer. Only transactions that have not yet been invoiced, voided, closed, or passed expiration (when applicable) are included in the listing. The listing is job specific and shows the ten (10) most recent documents.