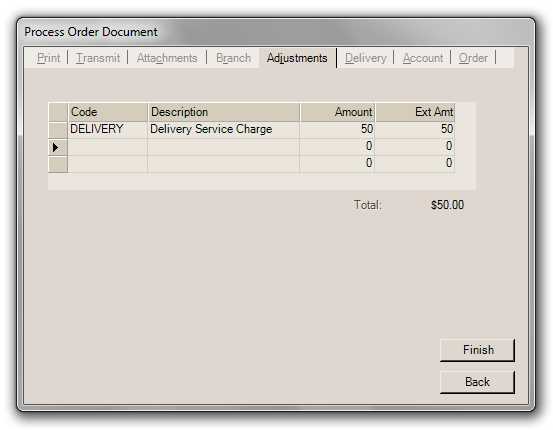

Orders > Process Order Document > Adjustments Tab

Adjustments (ALT-J) tab is to apply miscellaneous charges (fuel, tarping, etc.) to the order. You can add up to three adjustments per transaction.

Adjustment codes must be defined before use and may be applied to pricing based on a number of both methods and apply choices. Codes are defined by using the Adjustment Code Maintenance form. This form is accessed from the Database drop down menu and is available from the Point of Sale, Purchasing, and Inventory areas. For more information about adding, modifying, or deleting adjustment codes see the topic Adjustment Code.

Adjustment codes can be designated for use with

How are Adjustments Handled?

Adjustments provide a way of affecting transaction totals independently from the sale of products. Branch totals reflect adjustment totals and cost (if any) for the branch receiving credit for the sale (which may be different from the branch supplying the goods). Financially, the ledger also records adjustment income and expenses for the same branch (where the sale was credited). Inventory totals by item don't reflect adder amounts or costs. It is important to understand this when comparing the total inventory sales and cost for a period to any branch totals.