Payables > Reconciling Open Payables

Reconciling Open PayablesIt is recommended that reconciliation take place at the close of business on the last day of a calendar month; however, it can also be done on any given day during a month. We will be using the Payables report.1 This report includes real-time data that is sensitive to changes resulting from Payables activity. Due to this, this report should be processed at the end of a business day after all activity affecting payables has been completed.

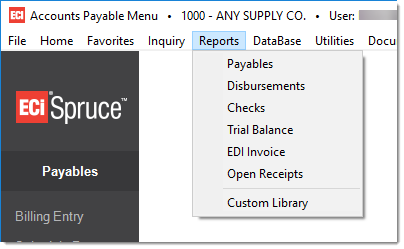

Step 1: Finding the Open Payables Total To find the current total for open (unpaid) payables, we will use the Payables report found on the Payables, Reports menu. To run the report, choose Payables from the Main menu, select Reports, and choose the Payables report. This report provides us with a listing of all Open Invoices.

A new form titled “Payables Report” will open. Under the Selection panel, set the “To Date” to be a date far into the future. This is necessary because we will be processing this report based upon Due Date, and we want to make sure all invoices are included. Select the Filter for “All Open.” If you have invoices that are “on hold,” but have been transferred to the ledger, the “include on hold” check box must be selected. View (F8), print, or save the report as a file. The report will have a column titled “Remaining.” The total amount for that column is the amount that you will be reconciling to the General Ledger AP account. Step 2: Transfer All A/P Make sure that all AP Invoices have been transferred to the General Ledger. This should include invoices on hold if they were included in step 1.*

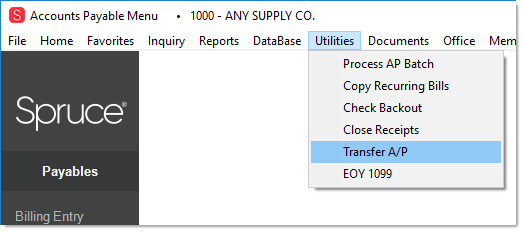

To transfer all A/P, go to the Payable area and choose Transfer AP from the Utilities drop down menu. After the form opens, choose the ALL radio button and press or click View (F8). This provides a listing of all AP invoices that have not been transferred to the General Ledger. Click on the blue menu marker and choose “Select ALL.” The AP Billing journal for theses invoices will create that night. *Invoices on hold need to be temporarily removed from hold status to transfer. They can be placed back on hold after. Step 3: Finding the Accounts Payable Balance in the Ledger The next day, select and post all payables journals in the General Ledger. You must be current with your postings to do this reconciliation. After posting completes, choose Inquiry, Account, enter in the AP General Ledger account. On the Totals tab, locate the cumulative column amount for the current cycle. This should match the “Remaining” total from your Open AP Report. 1There is a Crystal Report template available from our web site’s support area named AP Trial Balance Report. This provides a listing of invoices to a specific cutoff date; however, it's only based on current payables data and doesn't reference the actual payments made against invoices. This report doesn't provide an accurate "open" figure due to the reasons mentioned. |