Balancing the Check Register

There are things to consider when reconciling a bank statement to your Payables check register for the first time. Entries from any previous register are not converted, and need to be manually added before attempting to reconcile. In addition, the register balance must be set based upon whether or not there has been any payables activity.

Starting out Right

If the following steps are done soon after going live, your company will encounter fewer problems when performing your first reconcile.

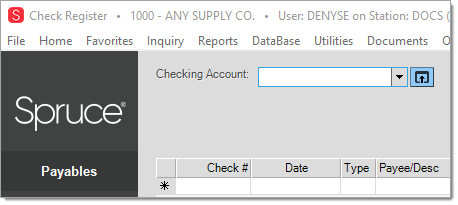

•After data conversion, check each register (bank account) from the Check Register in Payables.

Select each register using a date range that would include all entries from the time the server was installed with the Spruce software to the current (or a future) date. Ideally, there should be no entries at this time in the register. We are doing this to verify that this true. If there are entries that pre-date your live date, contact your trainer before continuing; otherwise, continue to the next steps.

•If there were no entries prior to your live date, navigate to the Check Register transaction found in the Payables area. Click on the Maintenance form icon to the right of the "checking account" drop-down control.

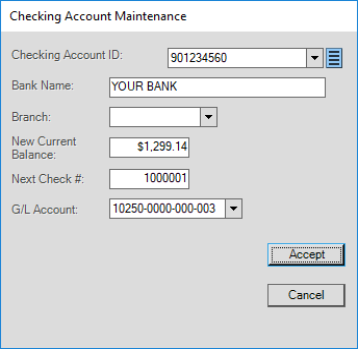

This will open the Checking Maintenance form. This form can be used to modify the balance on the register as well as the starting check number.

•If your register has entries that were done after your live date, please see the section, "What if I've already used my check register live?" later in this document.

•If your check register has not been used, modify the balance ("new current balance") on the Checking Account Maintenance form to match the ending balance from your company's most recent reconciled bank statement for this account.

If there is a difference between the balance that’s already displayed and the “new current balance” you enter, the software will create an adjustment for the current date. This adjustment is automatically marked as reconciled (R) so that it doesn’t have to be canceled (which would make reconciling more difficult). Modifying the “new current balance” adjusts the current (today’s) balance to match whatever figure is entered.

•Next, use your records to enter all outstanding checks, deposits, interest, and adjustments (including fees, etc.) as well as any other entries that were not part of the most recent reconcile (prior to using your Spruce software) into the register. Even if the register is not empty due to "live" entries, it is still necessary to enter these outstanding items. Do not re-enter any items that duplicate a new "live" entry, however.

We strongly suggest entering the details regarding each transaction individually rather than as one lump sum. This can help you more easily identify mistakes when you do your first reconcile using the application since it allows you to cancel (clear) items individually (otherwise, if the lump sum is wrong, it can be difficult to figure out why). Include all entries that will likely clear with the next bank statement as well as open entries from your prior payables.

•At this time, the current balance of the register should match the current balance from the prior payables record.

The check register is now ready for active use. Your company may maintain more than one check register. If you do, repeat this procedure for each register.

What if I’ve already used my check register live?

If a register has activity, getting the proper balance can be a bit trickier. Follow the list of procedures above, but before entering the “new current balance” on the Checking Account Maintenance form, some math is necessary to determine the amount to adjust the opening balance by.

Use the last reconciled ending balance (from the bank statement) and adjust that figure for any new “live” entries including and prior to the current date. If possible, do this before entering any missing records from the prior payable’s record (it’s easier that way).

Common Reasons for Reconcile Problems

• Post-dated checks. Balance adjustments always appear for the current date, so don't include any future items (if any) appearing in the check register when calculating a “new” opening (current) balance.

• When modifying the “opening” (today’s) balance, enter the actual balance, not an adjustment figure. The adjustment amount is calculated for you.

•When entering adjustments, be careful not to duplicate any payments that were open on the prior record but have since been paid on the “live” register.

How to Reconcile the Register

Reconciling the register can be very easy, assuming everything has been entered correctly into the register. Just as with a manual check book, reconciling can be difficult when clerical mistakes are made. Unfortunately, these types of mistakes are more likely during the first reconcile after your company’s live date because many more manual entries and calculations are being done.

The purpose of reconciling is to compare company records to the bank’s record in order to update the company’s records for the checks that have cleared the bank as well as deposits and other items (fees, interest, etc.) that the bank has processed. Reconciling never changes ledger balances and usually won’t change the register balance (unless you enter interest or service charges).

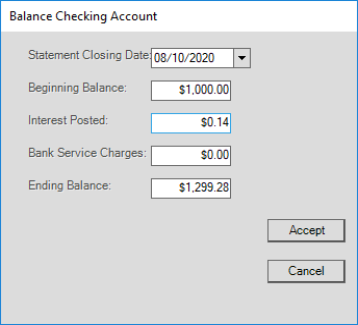

To balance a check register, select the account and dates (based on the statement’s billing period) and choose Balance (F5).

Reconciling involves a user entering the beginning balance from the bank statement, the ending balance, and optionally any interest or service charges that weren’t previously accounted for (see the image above).

Next, the reconcile form is displayed and the user selects (using the check boxes) all items appearing on the bank statement. These items are added or subtracted from the beginning statement balance entered.

At the end of this process (if done properly and all entries match the statement), the difference between the tally and the “ending” statement balance will be zero. This is the goal. When the difference is zero, the check register and bank statement are considered “reconciled” (meaning they match). Until this time you can “postpone” the reconcile process, but not complete it. If the reconcile is postponed, be careful to re-enter the proper beginning balance when resuming it. The beginning balance will reset itself back to the last reconciled balance if it was modified.