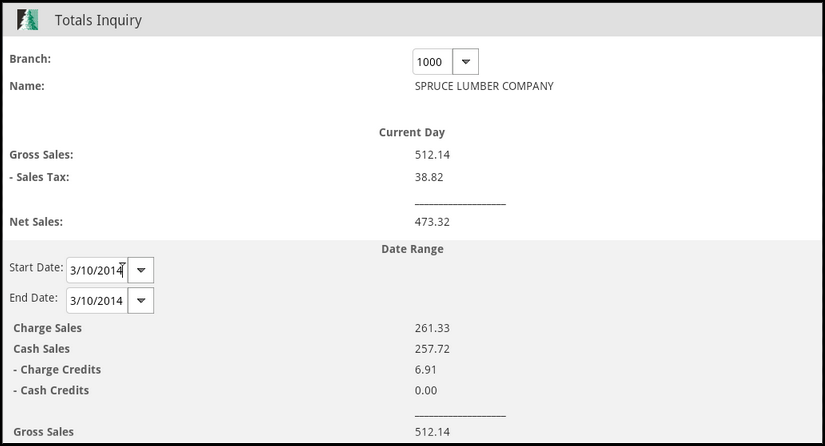

AnyWare Totals Inquiry

The AnyWare app allows users with permissions to view sales totals for any defined branch location they have access to. Security permission to use this feature are based on the access the user has to the Totals Inquiry in the application. You must select a Branch before displaying sales totals.

The Totals Inquiry form has two sections:

-

The upper (top) section of the form lists a summary of the current day's activity including the gross sales, sales tax, and net sales (gross less sales tax).

-

The lower (bottom) section, indicated by a gray background, is a scrolling area. You can slide this section up and down to reveal additional information.

To scroll this area, swipe from the bottom upward using your finger or stylus. Reverse the swipe to scroll in the other direction. The upper summary panel remains stationary and does not scroll.

Choose View from the Menu ![]() to refresh totals after changes.

to refresh totals after changes.

Selecting a Branch

Many businesses have more than one branch associated with their application. In these cases, branch selection is sometimes provided or required. Branch identifiers can be up to 4-characters in length and also have an associated text description.

Branch Picker

If your company has many locations, it may be best to enter a full or partial identifier in the text area then short press the Selection ![]() button to show the branch options that match.

button to show the branch options that match.

Otherwise, if you have a few branches or only one location, short press the Selection ![]() button to show a full list of branches, which may be faster than typing.

button to show a full list of branches, which may be faster than typing.

Branches Selection List

In the text area, you can also enter a full or partial branch name then long press on the Branch picker control and choose Name from the menu.

Any branch locations with names matching your selection will be listed.

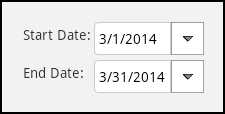

Selecting a Date (Range)

This area of the form allows you to view totals for a specified date range. Use the two (2) date pickers to choose a Starting and Ending date. The totals shown correspond with the selected branch. After choosing dates (and a branch location), choose View from the Menu to refresh the totals based on your selections.

Date Selection

Date selection may involve either one or two linked date controls. When two (2) date controls are present, they are usually provided for entry of a range of dates. In this case, one control is used to indicate the start date and the other the end date for the range. Soft keyboard (manual) entry for dates is disabled for date picker controls.

Date Controls

Short press on the button portion of the field (right) provides a calendar control that allows you select a date using the month, day, and year. Tap the "+" button above the date part to increase its value (ascending) or the "-" to decrease the value (descending). After the date matches the desired day, press the "Set" button.

Date Picker

Where a date range is allowed, a long press on either date field produces a menu listing preset date options that may be used to quickly set a range of dates.

Choices for ranges include: clear date, today, tomorrow, current month, last month, current year, and last year.

Date Options for Selecting Date Ranges

Totals are updated real-time as transactions are processed. Here's some specific information about the totals reported:

Charge Sales

This figure includes the dollar total for any charge sales, not including returns*, for the period requested. Sales tax is included in the figure. Charge sales is accumulated from both transactions that only involve "charge" and also those that involve "charge" mixed with other "cash-type" methods. For example, if a customer purchases $99 of goods and pays $50 in cash but charges the remainder to their account, the charge sales figure reflects that $49. Charge sales are not reduced by any statement (early payment) discounts.

* By returns, we mean transactions involving an overall total representing a refund amount. The individual status of each item on a transaction is not considered. If the overall total is negative, even if some items are being sold, the transaction is recorded as either Charge Credits or Cash Credits (depending upon the selected refund method). On the other hand, if the overall total is positive, the entire transaction is recorded as either Charge Sales or Cash Sales. A system or application administrator can either block or enable Point of Sale users ability to mix items that are being returned with those being sold by modifying a Task List item.

Cash Sales

This figure includes any sale, not including returns*, that involves a "cash-type" payment method. Besides actual cash, included as "cash-type" payments are methods such as checks, credit/debit cards, coupons, and gift cards. In addition, any COD (cash on delivery) designated sales are recorded in this figure. With COD transactions, the sales are recorded when the COD is created, not paid. Even if a payment for a COD involves a non-cash payment, the COD is still recorded under the "cash sales" category.

* By returns, we mean transactions involving an overall total representing a refund amount. The individual status of each item on a transaction is not considered. If the overall total is negative, even if some items are being sold, the transaction is recorded as either Charge Credits or Cash Credits (depending upon the selected refund method). On the other hand, if the overall total is positive, the entire transaction is recorded as either Charge Sales or Cash Sales. A system or application administrator can either block or enable Point of Sale users ability to mix items that are being returned with those being sold by modifying a Task List item.

Charge Credits (-)

This is the total of returns (credits) processed using a payment method of charge. These may be processed either in Sales or Charge Returns under Point of Sale. This figure includes sales tax.

Cash Credits (-)

This is the total of "cash-type" returns processed using a payment method of cash, check, credit/debit card, coupon, and gift card.

Why do one or the other? Notes:

We suggest blocking access to mixing returns and sales because (a) these types of mixed transactions can be difficult to locate and (b) you really aren't getting an accurate representation of both returns or sales.

Here's an example that helps explain why mixing the two can be a problem: Imagine that an active customer has claimed that they should see a credit on their account for an item they returned. If searching for the returned item, while only considering credits, you would never find the return because it was mixed with a sale. Finding the sale would mean spending time reviewing all of the customer's sales, not just the returns. This involves more work and is confusing to the customer.

Another reason not to mix sales and returns is discounts, particularly statement discounts. When a transaction is mixed with items being returned and being sold, some items may be net, some not. If a net sale had all "net" goods except for one item being returned, the transaction could wind up with a statement discount that is negative resulting in more of a charge to the customer. If you've ever needed to explain why a statement discount calculated to a customer, attempting to do so when there's a mix of negative and positive quantity items can be extremely difficult.

Gross Sales

Gross Sales is the total of Cash and Charge sales less any charge and cash credits. This figure includes sales tax.

Sales Tax(-)

This figure is the amount of sales tax charged to customers (not paid).

Net Sales

Net Sales is the Gross Sales total (Cash and Charge sales less returns) minus the total sales tax charged.

COGS (Cost of Goods Sold) (-)

This is the cost value (using weighted average) of the goods that were sold during the time period selected. Under normal circumstances, this figure should be lower than the Net Sales figure. If it ever appears higher, or wrong otherwise, examine the costs of the items sold during that time period (use date ranges to narrow down the problem to a particular day, if possible).

Cost Corrections (Corr)

The Cost Correction total represents the dollar amount of any cost of sales adjustments posted during the time period in question. These corrections are usually done because of errors made when goods were received causing them to be sold with incorrect costs. The cost correction total can be either positive or negative, so it's either subtracted or added to determine the gross profit figure (see below).

Gross Profit

Gross Profit is the dollar difference between the Net Sales figure and the COGS figure plus or minus any cost corrections. Profit should normally be a positive amount. The percentage of profit is displayed to the right of the dollar figure.

# Charge Sales

This is the quantity of receivable charge sale and credit transactions (documents) for the selected date range. Transactions involving any charge amount, even if other payment methods are used, are recorded under charge sales only.

# Cash Sales

This is the quantity of cash-type sale and return transactions (documents) for the selected date range. Cash-type includes payment methods of cash, check, credit/debit card, coupon, gift card, and any COD transactions. Transactions involving an account charge of any amount are never recorded as a cash sale here.