VAT Maintenance

The VAT Maintenance form (Main Menu > Point of Sale > Database > VAT) is provided for businesses operating in the United Kingdom only. VAT or "Value Added Tax" is charged on taxable goods and services. In the United Kingdom, registered businesses pay VAT on their purchases and services (output) and collect VAT at Point of Sale (input) which may be credited reducing what is owed to HMRC (Her Majesty's Revenue and Customs). The current rates are 20% (standard), 5% (reduced), and 0% (exempt). Each item may be assigned its own VAT location. Many other nations also use a VAT method of taxation, so rates may vary in those cases. A code named "STD" (Standard), if defined, is automatically assigned to taxable items if no other VAT location is selected.

Minimally, you should define one tax code for the standard rate. This code should be named STD (Standard). If you sell any items at the reduced tax rate, or any other rate, define additional tax codes for those rates and assign those tax codes to the items they apply to.

VAT Code

The application uses the 6-character code in transactions and utility forms requiring or allowing assignment of a tax location. Each tax location would have its own unique code. Each code can have up to three (3) separate levels if needed. Levels have an impact on how tax is calculated; however, they aren't tracked individually in any detail.

Description

This text-area provides a more detailed description for the tax location up to 30-characters.

Name on Invoice

This field allows you to enter a longer or shorter name for printing on documents that display a tax location. The maximum size of the "name" is 12-characters. The VAT location you want to use for Payables and Purchases should be give a "name on invoice" of VAT for UK-based transactions or GST in Australia.

Total Percent

This is the combined percentage including any levels. The actual percentage can vary in certain special cases such as with partially exempt items (clothing and food, specifically). Additionally, if a maximum sales tax amount (cap) is designated for any levels, the tax charged is not necessarily or completely based on a percentage of the transaction total.

Always Exempt

Check this box if the tax location is always exempt. This location might be defined for assignment to customers who have tax exempt status at all times. If a customer is assigned a default tax location that is marked as "always exempt," that tax location will be used in all cases regardless of the purchase location or delivery status of the transaction, and the tax amount calculated will always be zero. Otherwise, the tax location is treated as a "zero tax" delivery location, not an exempt tax code (this distinction is necessary because some areas simply don't charge sales tax, so even though they might have a zero tax rate, they are not exempt).

EC (European Commerce Only)

Select this check box when you submit HMRC Tax Returns that include taxes external to the UK. The EC Commerce flag (on tax locations) can be used to indicate taxes and totals in boxes 2, 8 and 9 of the HMRC Tax Return. Additionally, if recording VAT taxes paid to other tax entities separately (such as European Commerce) is necessary, you must define and use different tax locations to distinguish between those transactions and typical tax situations. Tax locations can be assigned to import vendors meeting the requirements, for example. Once you have authorised your ECI software, you can view past return data (inquire), liabilities, and payments.

Overrides Item VAT

The Overrides Item VAT entry determines whether the VAT code of the item or the branch is used in a transaction. In general, when the Override Item VAT setting is enabled for an Inc Tax Branch, the application uses the Branch tax setting to calculate the tax amount for Point of Sale transactions. However:

-

When either the Item or the Branch have an assigned tax code and the Overrides Item VAT option is enabled, the application allows changes to the tax code to a new override code only if the percent of the new tax code is less than the original tax setting.

-

When both the Branch and the Item have an Overrides Item VAT option enabled, the application applies the lower of the two tax percentages as the tax code for the transaction.

Use Tax (% of Cost)

This setting is used primarily for installed sales. If assigned to an Installed Sale contract this type of tax code indicates that the sales tax is to be calculated based upon the cost of the materials. Orders and Tickets can sometimes be assigned a "use" tax code, but only when the user processing the transaction has permission to access the installed sale area. When a "use" tax code is assigned to an installed sale contract, it is automatically assumed that any sales tax is already being included in the contract total (not added).*

*The "Tax Included" check box on the Installed Sale contract's Billing tab will be automatically checked and disabled (not allowing changes).

Always Taxable

Always taxable applies to products that don't qualify for any sales tax exemption. This may include luxury, vice, and other excluded type items (jewelry, candy, cigarettes, and alcoholic beverages, for possible examples). These items be assessed sales tax even if a tax exempt ID is associated with the transaction.

Note: The application does not calculate any tax for Always Taxable items if the tax location is also exempt or has a zero tax rate.

ECommerce

Select this check box if the VAT Code will be used in ecommerce transactions.

Defining Levels

Up to three (3) levels may be defined per tax location. Even though sales tax is collected as one sum, it may actually be paid to a number of different government bodies (state vs. county in the United States, for example). Levels allow you to specify the portion (percentage) paid to each. The fields for each level are: name, tax percent, and maximum tax. The software doesn't require that you define levels, so if there is no breakdown required by law or for tax reporting in your area, it's fine to leave this section incomplete.

Name

This is just a description used for the level. These could be general or more specific at your company's discretion.

Tax Percent

This is the tax rate for the level. Levels are set to the actual rate for the location/level... not a percent of the overall percentage. If the overall (combined) tax rate for this location is 8%, for example, and there are 2 levels, each might be 4%. Alternatively, one might be 5% and the other 3%. The percentages as a number should add up to the overall tax percent.

Maximum Tax

The maximum tax charged is a cap on sales tax for the particular level. For example, any level may have a tax cap of a set dollar amount. The sales tax is calculated using the other parameters for the level (percentage, etc.), but if that tax amount exceeds the "maximum tax" or cap for the level, the maximum tax amount is used instead. The maximum cap is not applied if a tax table is used.

*Clothing Tax fields have been removed since they weren't coded for UK use.

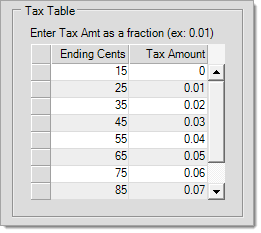

Tax Table

In some cases, sales tax is not calculated as a exact percentage based upon the transaction total. For example, some areas don't charge tax on amounts below a certain threshold and may also determine "break-points" specifying when tax is to be incremented. In these cases, a tax table is used to handle this situation. A tax table cannot be used along with the maximum cap provided with the levels. Tax tables are used first to set the sales tax amount. If no table is defined, we then check the levels for any maximum tax (cap) amounts.

A tax table determines how tax is to be charged on sales amounts both (1) below one dollar/pound ($/£) and (2) between whole dollar/pound amounts. The left-hand column is used for specifying ending cents in ascending increments. Each ending cent/penny point determines when one tax amount (in cents/pence) ends and the next begins (with the following cent/penny or next higher level). The right hand column is used for entry of the tax amount (in cents) charged from the prior break point to the current. Be careful, enter tax amounts as decimals (0.01, for example) not whole numbers or sales tax will not be calculated correctly!

Tax tables can be confusing, so here's a specific example:

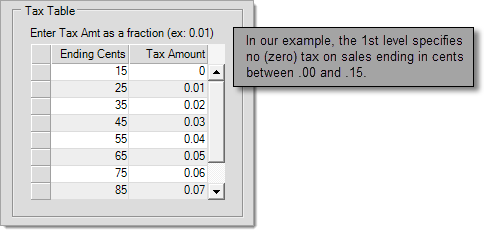

1. In most cases, there is a threshold amount for which no tax is charged; therefore, our 1st level is going to specify the maximum ending cents/pence that would not be charged any tax.

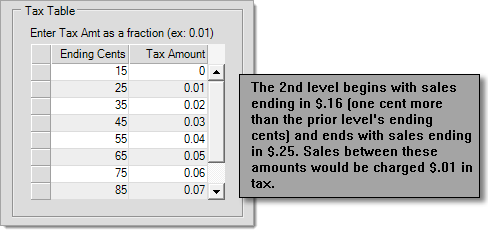

2. The very next level specifies the ending cents for the tax, in cents/pence, specified to the right. The beginning of the 2nd level's tax cents/pence range is one cent more than the prior level's ending cents/pence. Our 1st level's ending cent/penny amount was $0.15, so our 2nd level's range is applied to sales ending in any cent/penny amount between $0.16 and $0.25 (following our example).

3. Each level continues to increment in the same fashion until the maximum of 99 cents/pence ($.99/99p) is reached.

Do I have to use a tax table?

This really depends on the tax laws and rules for your area. Contact your area's tax department to find out. There is no requirement in the application that tax tables be used even if they are required by law in your area.

What if I do not use a tax table?

If no tax table is defined, sales tax is calculated based upon a direct percentage. The tax amounts are rounded to the nearest whole cent/penny.