Revolving Charge

Revolving charge is a new account option for receivables accounts. It provides the ability to bill a customer an amount based on either a percentage and/or minimum payment amount that may be unique to each customer.

The finance (or service) charge uses the existing options; however, the charge is calculated on either the entire balance at time of billing –or—the average daily balance during the prior billing period, not just past due amounts.

Revolving charge has the following aspects:

-

Customers must be Charge, Balance Forward, and Account billed.

-

A minimum amount due represented as a dollar amount to the customer on their monthly statement (bill).

-

The minimum amount due can be based on either a set dollar amount or a percentage of the total balance due.

-

In the percentage case, the amount is calculated at time of billing based on the outstanding balance at that time (the sum of all balances less any finance charges).

-

If a minimum amount is also specified, the percentage-based amount calculated is compared to the minimum. If less than the minimum, the minimum is used.

-

If there is no percentage, the minimum is the payment.

-

If the minimum payment is less than the total due, the total due is the payment.

-

Minimum payments are the only part of the customer’s balance that are aged. The remaining balance remains reflected as “current”

-

-

Finance/Service charges are assessed on either the entire balance (less finance charges) at time of billing –or—the average daily balance (less finance charges) at time of billing. A company may choose one (1) method.

Enabling & Options

This feature must be enabled by support personnel. Customers have the option of calculating the finance/service charge based on one (1) of two (2) methods:

Ending Balance (Default)

This takes the sum of the current and past due balances less open (unapplied) credits (at time of billing) multiplied times the finance/service charge percentage assigned to the customer.

Average Daily Balance

In place of the ending balance, we calculate an average daily balance for the prior cycle (the billing period being closed) and use that balance for the calculation using the finance/service charge percentage. The period considered runs from the day after the prior billing cycle through the current cycle end date. We take an average of the (current + past due – open credits) totals records for this period. That average is then used to determine the customer’s finance charge for the statement.

Any change to the calculation method made after billing will only affect future statements. Prior statements and finance charges are not affected.

The customer’s finance charge terms (30-Day, 60-Day, etc.) are ignored in the case of Revolving Charge. Finance charges are calculated on the entire balance (less credits), not just what’s past due.

Customer (Account) Settings

Customer account settings can be accessed from the Account Maintenance form available from the Account option on the Database menu in either Point of Sale or Receivables (from the Main Menu). The following settings pertain to the Revolving Charge feature specifically; however, there are other settings that have an impact on the account such as the credit limit and override type that are not specifically outlined here. Please refer to the application help for additional information on other settings.

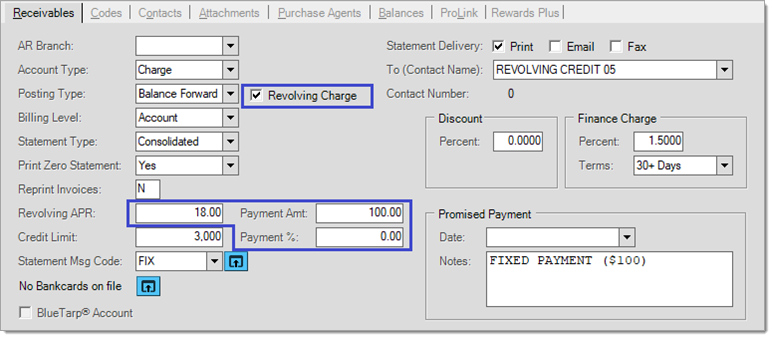

Revolving Charge (Check Box)

This control is only visible when the revolving charge feature has been enabled. If selected and processed, the feature will be enabled for the account (either a payment amount or percentage amount greater than zero must also be set). Once the Revolving Charge check box has been selected, values for Revolving APR, Payment Amt and Payment % must be entered in order for the customer to be considered a valid revolving charge account.

Revolving APR (Text Area) and Finance Charge Percent

The Revolving APR (Annual Percentage Rate) control can be used to set the monthly Finance/Service charge percentage. Whatever value is entered is not retained in the data, it’s simply a shortcut for setting the finance/service monthly percentage. If the monthly finance charge rate is modified, the change will be reflected in the “Revolving APR” as well. Changes made to either value will be reflected in the other.

Payment Amt (Text Area)

The Payment Amt (Amount) control can be used to set the dollar value minimum payment or regular payment when used without a percentage. If the next control (Payment %) is not set or is set to zero value, any amount in Payment Amt is considered the customer’s regular payment. When a percentage amount IS set, any amount in the Payment Amt field acts as a minimum payment. If the percentage amount calculated winds up being less than this minimum amount, the minimum amount will be used instead (unless the current balance is less than the minimum).*

*In cases where the current balance has dropped below the minimum amount, the current balance becomes the payment.

Payment % (Text Area)

The Payment % (percentage) control may be used to optionally set the percentage used for calculating the customer’s payment. A zero or empty value disables any percentage calculation and will cause the Payment Amt (Amount) to be considered instead. Any value greater than zero, will be used to calculate an amount as a percentage of the customer’s outstanding balance (current + past due). If the percentage is used without a minimum amount (Payment Amt), the percentage will always be the payment unless the amount exceeds the current balance. In this case, the current balance would be set as the customer’s payment amount. Current would become zero at this point and would be aged into the next past due balance should the customer not pay by the next billing cycle.

If a percentage is used along with the minimum, the percentage amount is used as long as it’s greater than the minimum payment. If not, the minimum is used as long as that amount is greater than the current balance. If not, the current balance is used.

Any current balance that is negative (credit) will result in no payment calculation. Finance charge calculations consider open (unapplied) credits; however, the calculation of the customer’s payment does not. This feature is restricted to balance forward accounts and a normal part of the Billing process involves posting open credits to balance forward accounts. For this reason, there should not be any open credits at time of aging when the payment is calculated.

Users must choose Process (F12) and accept or resolve any warnings/errors to save account settings.

Statement Billing

To use the revolving charge option, customers must be Balance Forward and Account (not Job) billed. In addition, they must also have either or both a non-zero percentage or minimum amount as described in the previous section. Should these conditions not be met, the customer will be treated as a regular receivables account for statement processing.

Finance Charge Assessment

Finance charges are assessed on the outstanding balance (current + past due) less (-) any open credits using the finance charge percentage assigned to the customer. The finance charge terms (30-Day, etc.) on the account are ignored.

The finance charge method (see Enabling & Options) determines whether the finance charge percentage is applied to the Ending Balance (Default) or the customer’s Average Daily Balance during the billing period.

When a customer’s revolving payment is based on a percentage, the finance charge is considered when calculating the payment.

In cases where the customer is assigned a fixed payment (no percentage), the fixed payment is not adjusted by any new finance charges. The “Amount Due Now” (AmtDueNow) and “Pay By {Date}” amounts reflected on the customer’s bill will include any past due amounts and previously assessed finance/service charge amounts plus the payment.

We suggest you periodically re-evaluate any fixed payment accounts in case payments need to be adjusted due to finance charges or other factors. This is not automatic.

Aging

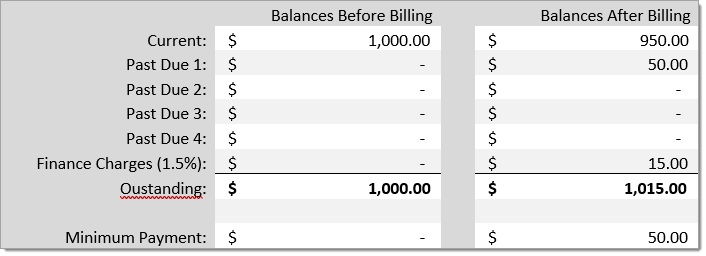

At time of billing, revolving charge customers’ first Past Due “bucket” (often represented as 30-Days) is set to equal their payment amount (as calculated as either a percentage or fixed/minimum amount). If not paid by the end of the next billing period, the payment is then aged further moving to the next older past due “bucket.”

The current balance is carried forward but is reduced by the payment amount. Consider the following example: a customer who has a no beginning balance for the period makes a purchase setting their current balance to $1,000.00. Their account is set up with a fixed payment amount of $50.00. At time of billing, they have a fixed payment of $50.00. After aging, their new current balance will be reduced by the payment amount. The payment is the only portion of the original $1,000 that is aged.

Statement Documents

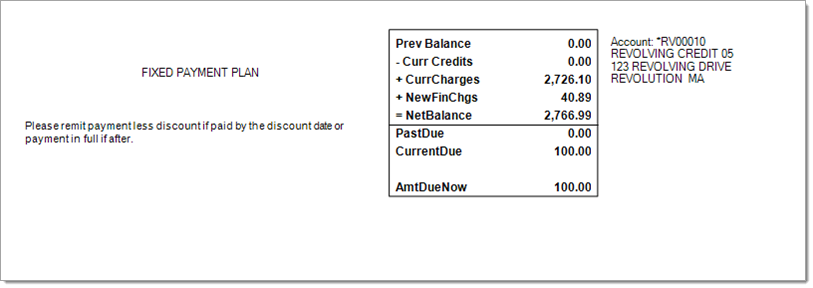

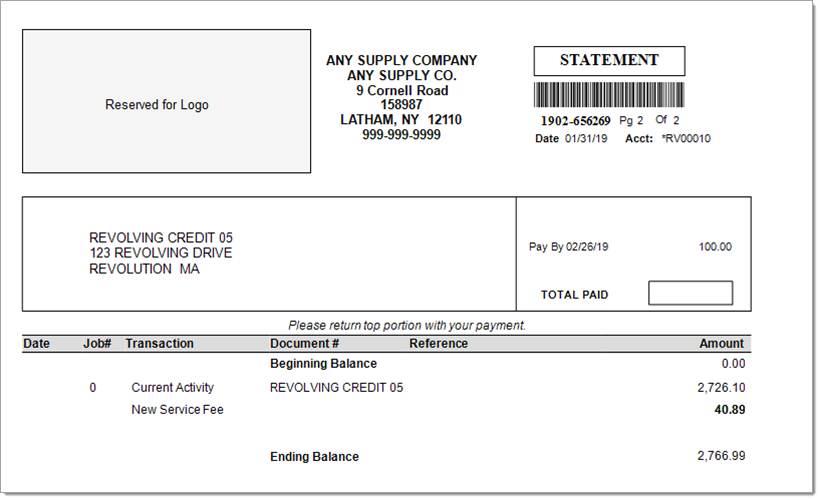

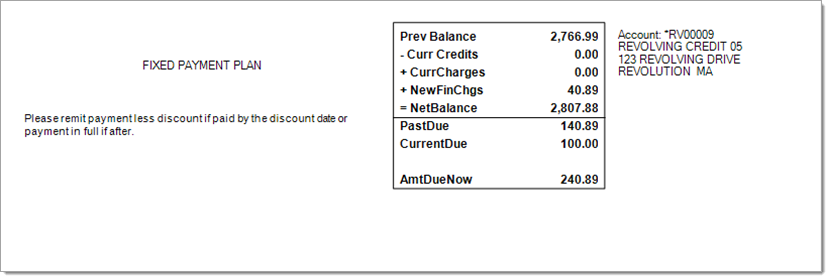

Statement representation is different for revolving charge accounts.

In place of the balance summary found on typical balance forward receivables statements, the customer’s previous overall balance, credits, current cycle charges, new finance charges, and net balance are included. The past due (if any) and current due (minimum payment) as well as the current due is listed as well.

In our example (above), the text “FIXED PAYMENT PLAN” is a statement message assigned to our test account. It does not print unless you define a similar message and assign it to the customer. You may want to consider using statement messages and or customer classes to distinguish Revolving Charge type accounts from other receivables.

The upper area of the statement page is the same as it would be for any other balance forward account except that the “Pay By {Date}” amount is the customer’s payment (AmtDueNow). An optional activity summary page can be printed.

The statement example we’re showing here is for the first bill the customer receives.

For future bills, the total payment will include any unpaid (past due) amounts from prior billing as well as any unpaid finance charges from those periods. New finance charges are not included in the Past Due.

We suggest using the Consolidated or Consolidated (No Summary) statement options with the accounts. Other statement options may not be supported or work well with this feature.

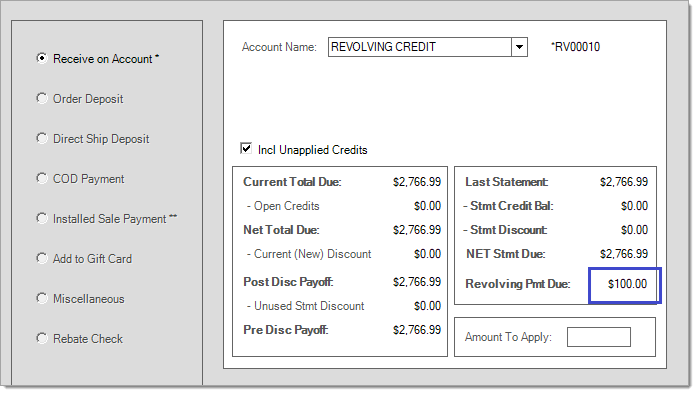

Point of Sale > Payments

The only difference with Revolving Charge accounts at Point of Sale is the Payments form when used to accept payments or “Received on Account” (ROA). In the case of a Revolving Charge account, the payment amount due is shown.

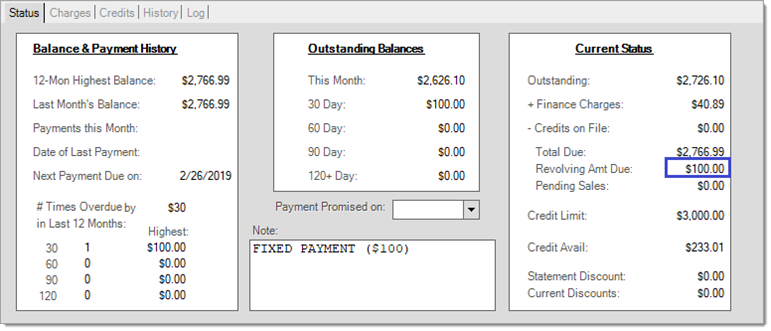

Receivables > Inquiry > Status

The Status inquiry accessed from the Inquiry menu in the Receivables area also displays the customer’s payment amount for Revolving Charge customer accounts.

Disabling/Discontinuing Revolving Charge

The revolving charge setting on a customer can be removed at any time. If this is done, the account will revert to behaving like a regular receivables account in the future. Immediately, the customer’s “amount due” will no longer appear on forms, so if you need this amount displayed, consider waiting until just before your next billing date to turn off the feature.

The first billing after disabling the feature will age the current balance into the first past due period. The current balance is not aged based on the dates of the original invoices that comprise the balance.