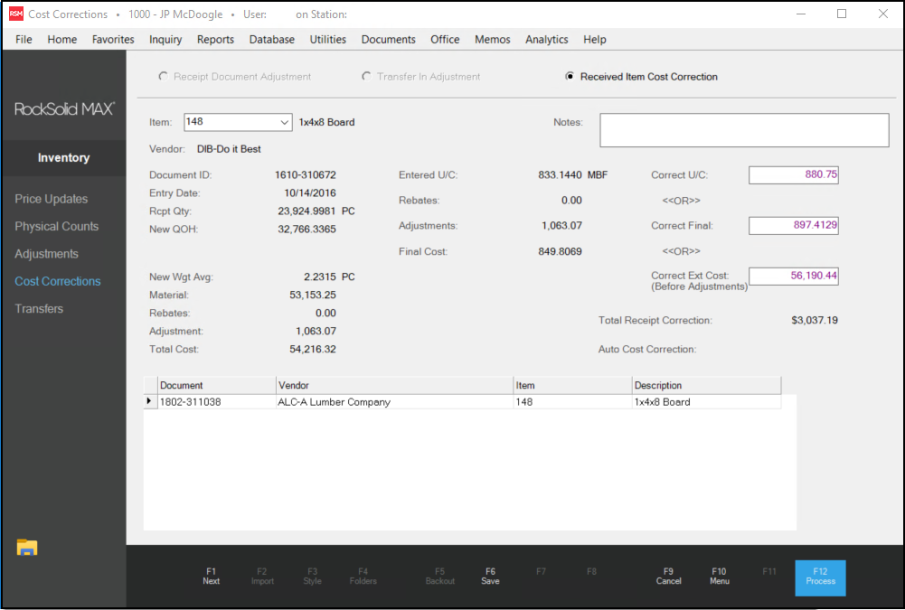

Received Item Cost Correction

This type of item cost correction is a more in-depth because it involves a specific receipt document (for a specific item) and updates a number of database figures and documents (including the receipt document). The total cost adjustment displayed is based on the Received quantity and the difference between the original receipt cost and new receipt cost (including any adjustments present for the receipt). Weighted Average Cost will be adjusted when costs change. When sales have occurred using an adjusted Weighted Average Cost, the application adjusts the related documents (invoices) and cost of sales totals for the item, account, and associate that performed the adjustment. The application keeps a separate counter in the branch totals table for cost corrections. When the previous cost correction has not yet been processed, the new cost correction displays in purple.

Note: When an item has previously saved cost corrections, they display in the data grid. You can review these entries before you process the new one and change or delete it if necessary. Corrections are individually applied but are combined on the same document. Review these entries before you process the new cost correction.

When updating documents (sales, etc.), cost corrections use a separate field in the document header table that is specifically for corrections. This is done so that the original document's costs are retained for reference and archival purposes. When you make a cost correction change, the application creates links between the cost correction document and any documents updated by the correction.

Note: If you are seeing item cost correction issues, check to see if the items with the errors have been returned. We often see errors associated with returned items when they are in the same transaction as a new item sale or order transaction.

Notes

Use the Notes text-area to explain the reason for the item cost correction. These are not document notes, but notes that are saved with each item and are listed below each item on the Item Cost Correction document. You can enter up to 256-characters for each note. Notes are not required for processing. Notes currently only apply to Received Item Cost Corrections and not Receipt or Transfer Document Corrections.

Entering the Corrected Cost

After you select a receipt document from the Item list, you have three options for entering a corrected cost:

-

Correct Unit Cost,

-

Correct Final Cost, and

-

Correct Extended Cost

What's the difference between the Correct U/C and Correct Final costs?

The Correct U/C is the "per item" cost before any adjustments. If you choose this option to enter a correction amount, any adjustments will be added to or subtracted from (depending upon the adjustment type) the cost to calculate a "new" final cost. Adjustments will not be included in the calculated extended cost figure.

When you enter a Correct Final instead, the amount should already include any adjustments. The application will back out any adjustment amounts from the original receipt to display the calculated Correct U/C and Correct Extended Cost.

If you choose the Correct Extended Cost option, you enter the extended cost for the item (quantity X unit cost) without adjustments (if adjustments are involved, they will be considered separately).

Total Receipt vs. Auto Cost Correction Amounts

After you pick a cost type and enter an amount, the application does some calculations and two figures display as the result: Total Receipt Correction and Auto Cost Correction. The Total Receipt Correction is the cost difference in dollars between the original receipt document and the new cost you entered. The Auto Cost Correction amount is the total "cost of sales" adjustment that will be made when you process the correction.

Cost of sales is the cost of the goods sold in Point of Sale transactions. A correction is necessary for received goods if those goods have since been sold using a cost that the receipt affected. The correction must "fix" the cost used for those sales. When sales are processed, the cost of sales is based upon the Weighted Average Cost of the items. The application recalculates the Weighted Average Costs when goods are received (it's an average calculated by adding the weighted average value of goods currently in stock and the new cost value of the goods being received then dividing the resulting figure by the new total quantity).

Because existing weighted average costs are used to calculate any new weighted average cost, cost changes to a receipt can potentially update the costs on large numbers of documents. The more active the item or further in the past the correction is done, the greater the number of documents that potentially may need correction. For an example, if item XYZ has been received four times with four different costs and the oldest receipt cost is adjusted, all sales since that receipt could potentially need to be adjusted. This is because the existing costs would not have been correct each time the weighted average cost was re-calculated for the three subsequent receipts making the new weighted average incorrect each time.

Should the Costs Match?

Not usually. Although it's possible for the Receipt Correction and Auto Cost of sales Correction amounts to match, this would be unusual. The Auto Cost Correction amount is based on the item's sales activity, which is likely to vary from the receipt document's correction total.

How can I tell what was affected by an Auto Cost Correction?

There are a number of ways to do this. When cost corrections are processed, a document is created. The document will contain links to any Point of Sale transactions, etc. that were adjusted as a result of the item receipt correction. To view these, click on the Documents tool and then after locating the Cost Correction document, choose Links.

You can also use custom ActiveReports to locate correction documents. You can access cost correction reports for free on our Customer Portal web site.

What get's updated by the correction?

After you complete a cost correction using this process, the application will update documents that would have updated cost of sales, including invoices and charge returns. When you make this change you modify the item's weighted average cost. In addition, cost of sales figures recorded for inquiries such as totals, accounts, jobs, and the item are adjusted. When more than one branch location is involved with a sale of goods, cost corrections are done for the branch supplying the materials only.

Why doesn't an item's Last Receipt Cost update after doing a Received Item Cost Correction?

Only the item's Weighted Average Cost is adjusted when a receipt item type cost correction is done. There are a few reasons for this:

•The Receipt being updated is not always the most recent purchase, any receipt can be adjusted.

•Adders may be involved. Adders are included in an item's weighted average cost but not the Last Receipt cost. Applied adder amounts vary from one purchase to another, so it does not make sense to include them in the Last Receipt cost.

•Last Receipt and Market Costs are provided primarily as a reference for purchasing. They are not used for updating cost of sales or for valuation purposes. The main purpose of Cost Corrections is to make sure that items will be sold or returned using the proper costs, or if they have already been sold/returned with the wrong cost, to correct the cost that had been used for those sales.

Will the Cost Correction Total for the documents always equal my Auto Cost Correction amount?

The Auto Cost is a sum of all the correction amounts, but it is not necessarily a "net" amount of the correction. This sum represents a total of adjustments regardless of whether the particular adjustment is an increase or decrease in cost of sales. Charge return documents represent a reduction in cost of sales rather than an increase, and they can be affected by a cost correction. However, the amounts on a Charge Return type document are represented as positive figures rather than negatives ("cash" type returns are represented as negative figures and do reduce the Auto Cost amount). The inclusion of a charge return document in a correction can increase the Auto Cost correction but reduce the actual total correction applied.

Saving, Modifying & Processing

Once a cost correction has been specified for the selected item and receipt document, choose the F6 (Save) function. This moves the correction into the data grid in the lower section of the form. Repeat this process for each individual correction. Saving a correction does not complete processing of the correction. Saved corrections can be modified (after selection via the data grid). When a previously "saved" correction is selected for modification, the Save (F6) function is relabeled as Modify (F6). You can delete a saved correction by selecting the data grid row and choosing Delete (either by pressing the Delete key or choosing Delete from the context menu). You can continue to make cost correction changes in the Cost Corrections form and choose Process (F12) to update the inventory records in the database. To clear or remove any "saved" corrections before processing, choose Cancel (F9), Menu (F10), or navigating back to another selection on the main form.

Saved cost corrections are not finalized until you choose the Process (F12) function key. Only cost corrections that have been saved in the data grid are processed when you choose Process (F12). This allows for entry, review, and processing of multiple corrections all at one time. Choose Process (F12) after all corrections have been made to update the appropriate documents with the changes. All saved corrections that were processed will be listed on the same Item Cost Correction document together.