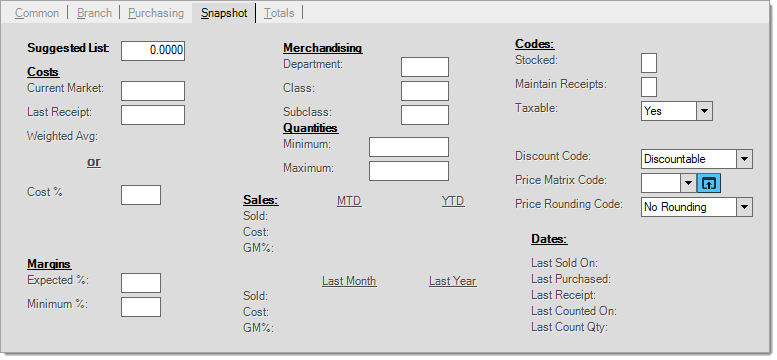

Item Maintenance > Snapshot Tab

The Snapshot (ALT-S) folder summarizes a variety of information related to the item. Some information is duplicated (also appears on other folder tabs), but is included on this folder tab for reference here as well.

Suggested List

This is a reference price that is used for comparison purposes and a basis for calculating price levels designated as a discount off the suggested list price. Suggested List is not itself a price level and cannot be assigned as the default price to customers, etc.; however, you can always set one of the level prices to match the suggested list if you want to.

Costs

There are several costs associated with each item (when costs are maintained): current market, last receipt, and weighted average. Several parameters as well as other item settings do affect how and if these costs are updated.

Current Market

This is a cost that may or may not be automatically updated. Two Inventory Parameters, "Set Market Cost with Last Receipt Cost Change" and "Include Adjustments" control how the Current Market cost operates. Current Market cost can either be (1) a manually adjusted cost used by your company as the "going rate" for purchasing the item or (2) it may be automatically set to match the last receipt cost (with or without adjustments). Due to these parameters as well as a few of the item's other settings, there are several different ways the "current market" can operate:

•If the parameter to update market cost when the last receipt is updated is not enabled and the current market cost is set to zero, the market cost won't be updated when receipts are processed.

•If the parameter, "Include Adjustments" is enabled for use along with the Set Market Cost with Last Receipt Cost Change parameter, the current market cost will include any adjustments applied during receiving; however, the last receipt cost will not.

•If the item does not maintain on-hand quantities (see the "Track Qty On-hand" setting on the Common, Codes tab) and the market cost is set to zero, none of the item's costs will update (this includes current market, last receipt, and weighted average).

When adding a newitem and specifying a non-zero cost, both the last receipt and weighted average are set to match the initial Current Market cost entered.

Last Receipt

This is the cost from the most recent receipt of this item. This cost is updated at time of receipt as long as the item is set to track quantity on-hand (see the Common, Codes tab for this setting) and the item's market and other costs were not previously set to zero. Last receipt cost does not typically include adjustments (such as freight, for example); however, the item's weighted average always include adjustments (this typically is the reason for any difference between the two costs on a new item).

Transfers between branches can optionally update the last receipt cost if the Inventory Parameter "Update Last Receipt Cost on Transfers" has been enabled. If this parameter is notenabled (checked), neither the last receipt nor the last receipt date will be updated by transfers.

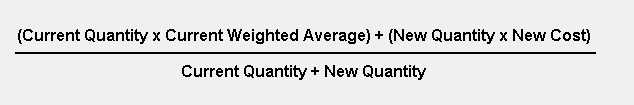

Weighted Average

Weighted average is calculated at time of receipt and when a product is returned if an original invoice is specified. Items that do not maintain on-hand quantities will also not maintain any weighted average cost. Weighted average is calculated by multiplying the cost value of your current stock times the value of the stock being received (or returned) then dividing this figure by the total (or new) quantity.

An item's weighted average cost is calculated including any adjustments (such as freight, etc.).

Merchandising

Merchandising classifications can be used for reporting, analysis, and global changes to items. These can be used for any purpose your company finds useful.

Quantities

An item's "minimum" and "maximum" quantities are used primarily for purchasing to help determine when to replace diminished stock (or when not to). There are other settings used along with minimum and maximum quantities that are not displayed on the "snapshot" tab, but are located on the "purchasing" tab (ALT-P) instead.

Margins

The "expected" margin percentage is used for comparison to actual margins from sales of the item to determine whether or not a sale should be flagged as an exception.

The "minimum" margin is used to set a low margin limit for comparison to actual margins from sales. This should be the lowest margin your company is willing to sell the given item at.

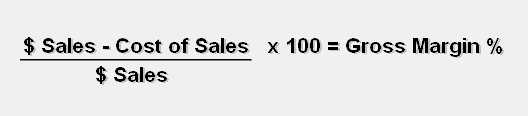

Sales

Sales, cost of sales, and gross margin % are reported for the current month and year (above) and also for the previous (last) month and year. Sales figures don't include sales tax. Gross margin is calculated using the following method:

Codes

This area displays item settings found under the Codes (Alt-O) tabs on other folders as well.

Stocked

"Stocked" refers to whether an item is maintained as a part of inventory or not. Items that are regularly received and sold are usually considered stocked. Goods that are only ordered when a customer requests them or that have some unique characteristic tend to be "non-stocked." The "stocked" flag changes the function of the inventory item during grid entry. Items that are not stocked prompt for additional information in a special form.

Maintain Receipts

"Maintain receipts" determines whether or not inventory receipt details should be kept for the item.

Taxable

The "taxable" code can be set to the following: yes, no, always, and VAT (value added tax). Taxable "always" items will charge sales tax regardless of the customer's (account/job) taxable status. VAT (value added tax) is a tax that is included in the price of the goods being sold already. In the case where VAT is used, the manufacturer, supplier, and retailer would be responsible for paying the taxes on goods they manufacture, distribute, or sell.* The consumer would pay the tax indirectly as the tax is already included in the price. This is done in place of an added charge the consumer pays at time of sale. Canada, the EU, India, and many other nations have instituted VAT tax rules. The United States does not use VAT.

*Tax rules vary based on location. Contact the appropriate government department, office, or a tax professional if you have questions regarding your location's tax status, laws, and rules.

Discount Code

"Discount code" determines whether an item can be discounted or not during sale. Items are either "discountable" or "net." Net items are not eligible for discounts.

Price Matrix

A price matrix is a list of coefficients used when doing price changes to affect pricing using a "base" price selected by the user. For example, we'll assume an item has a coefficient of 1.00 for "retail" and 1.05 for price level "delivery." If this matrix is applied (in a price change) to "retail," the "delivery" price level would changed to be 5% more than retail. Matrices should be set up with an intended "base" price type in mind (retail, weighted average, replacement cost, etc.). Coefficients used with costs instead of pricing would be different.

Price Rounding

"Price rounding" may be optionally used to round prices using a number of methods. Leave this field set to "no rounding" to leave pricing "as is" during sale. Prices can be rounded to the nearest cent (.01), ninth cent (.09), whole dollar ($1.00), or five dollar ($5.00) increment.

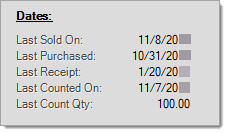

Dates

This panel displays date information about the selected item's most recent sale/return, purchase/receipt, and physical inventory when applicable. All dates and physical count are displayed for the current branch only.

This is the date that the item was last sold or returned at the current branch location. If the item has never been sold or returned, no date is displayed.

This date is the most recent date that a new or existing purchase order (containing this item) was saved for this branch location. The purchase order's due date is not used. The order status of the PO is now considered when setting this date (available in releases after 6.5.2). In the past, "last purchased" dates were set for items regardless of whether the purchase order was being marked as "ordered" or not. Now, only purchase orders that are being "ordered" will update the last purchased date for ordered items. If the item has never been saved on a purchase order, no date is displayed.

The last receipt date is the most recent inventory receipt of this item for the current branch location. This date is updated regardless of whether the item was received using a purchase order or not. IF the inventory parameter "Update Last Receipt Cost on Transfers" has been enabled (checked), last receipt date will be updated by transfers for the receiving branch; otherwise, the last receipt date is not updated by transfers. If the item has never been received, no date is displayed.

This is either the date of the most recent count or the most recent date that a count was posted (which ever date is the latter). If the item has never had a count entered (or posted), no date is displayed.

If an item has been counted or posted, the quantity of the last count or most recent posted count is displayed here. If no count is displayed but a "last counted on" date is displayed, counts for the item were likely initialized (cleared) since the last count or physical inventory.