Finance/Service Charges

"Finance Charges," also referred to as "Service Fees," are calculated as a percentage of the past due amounts a customer owes. There are both parameters and customer (account/job) settings that affect if and how finance/service charges are assessed. Finance charges are not required; however, they are commonly used with receivables and typically are applied when a customer carries a balance beyond at least one full billing period. A "billing period" would be one cycle after the customer is billed for their purchase. Your company can optionally give customers more time to pay their balance before charges are assessed.

Finance charges are assessed on past due balances by monthly billing processing. This process is scheduled to run on a specific day of each month (the 1st or 25th, for example). The time of day determines which date is used for the statement documents (early AM would use the prior day's date, PM before midnight would be the same day's date). Finance charges cannot be manually assessed and there are no "invoices" associated with them. Debit adjustments can be used to add a charge to a customer's account but won't be recorded as a finance charge.

Customer, and sometimes job, settings determine at what point finance charges are eligible on past due balances. For most accounts, this means a balance or open items which have aged into any of the four (4) past due periods provided (30 days, 60 days, 90 days, etc.). Finance charges are only calculated once per cycle either on the day billing is done or, upon request, another specific day of the month. A setting called "Terms" is provided for each account (and jobs, in some cases) to determine which past due balances are to be considered at the time the finance charges are calculated. Finance charges are calculated on the past due balances only. These balances exclude any previously unpaid finance charges (assessing additional finance charges on existing finance charges is illegal in most areas).

Job billing accounts treat jobs like separate accounts for the most part. In this case, each job maintains independent balances and are individually assessed finance charges when applicable. Jobs can optionally calculate finance charges differently from the main account when "job billing" is used. "Account" level billing customer accounts don't offer the same options for jobs. Both types of accounts can have jobs, they just operate differently.

Receivables Parameters affecting Finance Charges

All of the parameters which influence finance charges are located on the Receivables tab of the Parameters form (Maintenance, Database menu).

Verbiage... "Finance Charge" vs. "Service Fee"

Each company has a choice about the terminology used for these charges ("Statement Verbiage"). The fees assessed for late payment can be referred to on statements as either "service fees" or "finance charges." When viewed from the software; however, the terminology used is almost always "finance charge." There is no functional difference between the two except for the wording used on some customer documents. In the remainder of this document, we'll refer to these fees as "finance charges."

Default Finance Charge

This is simply a default percentage used when adding new customer accounts. The default can be modified to any other percentage when adding or modifying accounts from the Account Maintenance form.

Minimum Finance Charge (Minimum Fin Chrg)

Your company can set a minimum finance charge amount (in currency) that will be used whenever a customer carries a past due balance. The minimum amount is used whenever the customer has a past due balance and the calculated finance charge on that balance is lower than the minimum. For example, if the customer's past due amount is $15/£15 and finance charge percentage is 2%, the customer's calculated finance charge would be $0.30/30p; however, if the minimum finance charge is set to $1/£1, the customer will be charged more: $1.00 or £1. The parameter "Min Bal for Fin Chrg" is also considered.

Minimum Balance for Finance Charge (Min Bal for Fin Chrg)

This allows your company to set an optional threshold past due amount in currency. Unless the past due exceeds this threshold, the customer won't be charged any finance charges (including the minimum).

Finance Charge Date

This field requires additional support assistance. If used, the "finance charge date" can be used to assess finance charges on a different (earlier) date than you process billing. Although finance charges are calculated earlier, the amounts are not available on documents until the billing period is closed.

Customer/Job Settings affecting Finance Charges

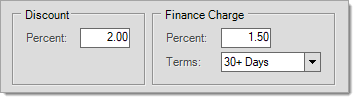

Accounts offer two (2) settings for finance charges: percentage and terms. The percentage determines how much finance charge is to be assessed on past due balances (previous finance charges are not included in these balances). "Terms" determines how far past due a customer may be before finance charges begin to be assessed. This is based on the aging performed monthly by the billing process, not a specific number of days.

Account Maintenance: Finance Charge Settings

For accounts that use "job" billing, each job is treated similar to an account. In this case, the jobs each maintain balances and are assessed finance charges independently. Both the percentage and terms cycle are available for jobs when the account is enabled for "job" billing. You must clear the "Use Master Setting" check box on the job's "Overrides" tab next to these fields to specify a percentage or terms cycle that is different from the master account's.

Job Maintenance: Finance Charge Overrides

Finance charge fields are not displayed unless the job's master account is "job" billing.