Understanding Statement Settings for Accounts and Jobs

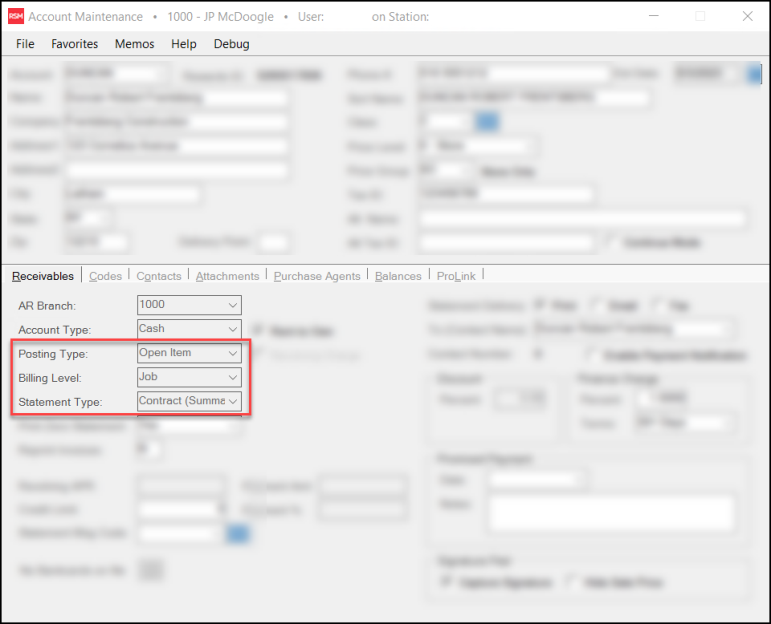

Your account statements are generated based on a specific settings in the Account Maintenance > Receivables tab that we describe in detail in this topic.

The three most important settings that determine an account's/job's statement format are:

1.Posting Type

2.Billing Level

3.Statement Type

Some other settings are important too, but don't affect the structure of the statement. These have more to do with delivery and other options:

1.Print Zero Statement

2.Reprint Invoices

3.Statement Delivery

Some settings may not be modified once an account becomes active.

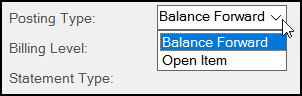

Understanding the Posting Types

There are two posting types used for charge accounts: balance forward and open item. These types relate to statement format, but also affect how a customer's account functions with regard to payments and posting.

Posting Type Options

Balance Forward Posting Type

This account type is used for customers who pay by balance, not individual invoice. Here are some quick facts:

•Balance forward statements have one or two pages minimally. The statement includes one or more summary pages (optional) followed by the statement page(s).

•Statements never list details for charges older than the current period (the month that the statement is run for). Instead, a line listing the "balance forward" includes the total of all unpaid charges from prior periods.

•Details regarding the amounts remaining at an invoice level are not provided. Current sales activity is listed on the summary page, but all activity is listed regardless of payment status, so it won't necessarily match the total due.

•Balances are aged based on the number of billing periods the balance remains open (not paid).

Open Item Posting Type

Open item accounts are used with customers who pay by invoice, not balance. These accounts send their remittance (payment) with an indication of where they'd like their payment applied. Here are some quick facts regarding open item accounts:

•Open item statements may be between one to three pages minimally.

•These customer's statements may include an optional summary (activity) page listing all open items, one or more statement pages, and at least one optional remittance page.

•Remittance pages are provided so that a customer may (a) mark which items they are paying and (b) indicate where any unapplied credits should be applied.

•The activity summary and remittance are only generated for the overall account regardless of billing level. If these pages are optionally disabled, no summary information is provided at all.

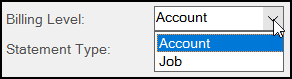

Understanding the Billing Level

There are two billing levels: account or job. Billing Level determines whether a customer's receivables function collects and records

-

at the job level, or

-

at the overall account level

This setting determines how account balances are recorded, how payments are remitted, and whether the application creates separate "job" statements or not. It's important to point out that billing level does not determine whether the account can have jobs. ALL accounts can have and use jobs regardless of billing level or any other account settings. Billing level merely impacts the function of the account with regard to jobs.

Billing Level

Billing Level affects more than just statements, so here are some questions you should discuss with your customer before you choose a Billing Level for the account:

-

All accounts can have jobs, and statements can list job activity at either the account level or the job level.

Accounts can track all of the account activity by job, regardless of the account's billing level. Job Billing does change the functionality of jobs and the formatting of statements, however. -

Does the customer want to list each job as a separate statement or can one account statement list all of the job activity?

Job Billing provides individual pages for each job on the account.

Account Billing lists all of the jobs associated with the account, but not as separate pages. Account billing can still provide a summary for job activity. -

For each type of Billing Level, how does the customer want to submit payments?

Use Account Billing to submit one payment or all account charges, including each job.

Use Job Billing to submit payments by job individually. -

Does the customer want to track aging for each job or for the overall account (Consolidated) only?

Use Account Billing to age balances for the entire account only (Consolidated).

Use Job Billing to age balances by job. -

How does the customer want the statement(s) to be delivered?

Customers can choose to receive delivery in a variety of ways.

Consolidated account statements are delivered to the account's primary contact via print (mail), email, or fax, since the statement contact does not exist at the job level. The Billing Level of the account doesn't affect the method of delivery or the contact (the person the statement is directed to). When a customer wants to deliver "job-based" statements to different contacts, consider setting up separate accounts rather than jobs. -

How does the customer want to handle finance and service charges or discounts?

Use Job Billing to calculate and apply charges and discounts for each individual job separately.

Use Account Billing to calculate and apply charges and discounts to the consolidated account only. -

How does the customer want to manage adjustments and credit memos (charge returns)?

Use Job Billing to apply adjustments and credit memos only to specific jobs. Credit adjustments may not be applied across jobs on Job Billing accounts.

Use Account Billing to apply adjustments and credit memos across jobs associated with the account. The Consolidated check box must be selected during posting to ensure the adjustments are applied correctly.

Note: Under Account Billing, the application applies returns to specific jobs initially.

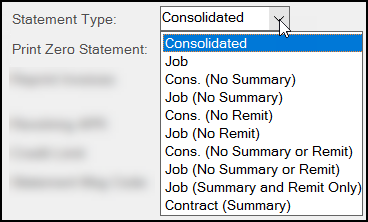

Understanding the Statement Type

Statement type is the most flexible billing preference because you can change it without restriction. For changes to a customer's statement type, the settings in place at the time statement documents are created are used when the statements are delivered (printed, emailed, or faxed). Changes you make after billing is processed won't be apparent until the next billing period. All ten statement types may be assigned to any type of account; however, statement types are often misunderstood, so let's begin by explaining the two purposes of this setting: defining the sorting order and choosing the optional pages.

Sorting Order

The primary function of Statement Type is to determine the sorting order used when printing statements for the account. This sorting order is applied to the various statement pages (some of which are optional). Consolidated sorting organizes the statement by date and then by job. Job sorting organizes the statement by job and then by date.

Consolidated

Consolidated-type sorting is "date/job" sorting.

Date Job# Transaction Document # Reference Amount

10/01/2009 1 Invoice 0910-012345 47.52

10/12/2009 9 Invoice 0910-023456 126.66

10/13/2009 0 Invoice 0910-023567 19.92

10/21/2009 7 Invoice 0910-023681 821.42

Job

Job-type sorting is "job/date" sorting.

Date Job# Transaction Document # Reference Amount

10/13/2009 0 Invoice 0910-023567 19.92

10/01/2009 1 Invoice 0910-012345 47.52

10/21/2009 7 Invoice 0910-023681 821.42

10/12/2009 9 Invoice 0910-023456 126.66

The Statement Type does not determine whether a separate statement prints for each job! Billing Level (account vs. job) determines whether separate job statement pages are generated or not. For example, a customer with account level billing who is assigned to a job statement type would still not receive individual job statements.

Statement Type only determines the sorting order of activity being listed (ordered by date vs. job). Billing level and account type have a far greater effect on the actual structure of the statement. Remember, any type of account can have jobs, these settings just determine how the customer's bill appears and how payments are handled.

Optional Pages

The customer can choose from a wide variety of statement formats so they can see their account information as it is most useful to them. See Statement Formats Compared to learn more about these options.

A secondary function of the Statement Type is to determine whether optional summary and/or remittance pages are enabled. Although there are no restrictions on the "Statement Type" assigned to a particular customer, some choices make more logical sense than others. Here are some things to consider when choosing a Statement Type for an account:

-

For customers assigned a Billing Level of Job, both the Summary and Remittance pages only apply to the overall account's summary not the individual job's summaries.

-

The application does not provide individual job statements with independent Summary and Remittance pages. The statement shows only the overall account summary on these pages.

-

If a Job Billing customer chooses the "No Summary or Remit" Statement Type, the statement contains no account summary or remittance pages at all. These pages are the only components of a "Summary" statement, so disabling them effectively eliminates any type of overall account summary.

-

Remittance pages only apply to Open Item Posting accounts

-

The "No Remit" and "No Summary" pages are the same for Balance Forward Posting accounts. So a Balance Forward Statement would not include a Summary page if their Statement Type is either "No Remit" and "No Summary" pages or both.

-

Job Billing Level Accounts normally print a Summary statement for the account. This overall summary includes is 1-2 pages and only includes an Activity Summary by Job and a Remittance page. Keep in mind that Remittances are only available for Open-Item Posting type accounts.

Other Statement Options on the Receivables Tab

Reprint Invoices

Invoices can be reprinted with an account or job Billing Level.

-

For Open Item Posting customers, the application only prints the statement showing the unpaid invoices and credit memos (open items that were printed with a previous statement are not reprinted again).

-

For Balance Forward Posting customers, the application will reprint any invoice or return from the billing period regardless of payment status. When the account chooses the email delivery method, these invoices are in one PDF file attachment. The number of invoices is included in the file's name.

Statement Delivery

Your customers can specify one contact person for an account (not each job) to whom statements are to be delivered (printed, emailed, or faxed). They can also specify several methods of delivery, although at least one selection is required. Fax and email processing has specific requirements and depends upon configuration outside the application. Because the actual processing of faxes and emails occurs outside the application and database, it's important that someone at your company monitor faxes and/or email to make sure they are functioning properly.

Email delivery is the most economical because it requires the least amount of time to process and the smallest amount of user involvement. Faxing is the second easiest, but faxes do take more time to process so it's not a good choice for a lot of statements and each fax sent involves a separate telephone call. Printing is the most expensive and time consuming choice due to the amount of time and expense required for printing, packaging, and postage.

Statement delivery choices are the only options that can be modified after the creation of statement documents and still have an effect on how statements are delivered for the prior billing period.

Print Zero Statement

Use this setting to suppress statement printing if the account has either a zero balance or no activity for the current billing period. In most cases, the application still generates the statement, but the document is not printed, faxed, or emailed.