Credit Adjustment

Credit adjustments may be used to add a credit to a customer's account, decreasing what they owe. This is usually done to correct billing errors or to write off a finance charge, for example. For some types of corrections, it is best to process a credit sale than just do an adjustment. Credit adjustments won't affect sales tax totals or adjust inventory levels like an actual credit sale will.

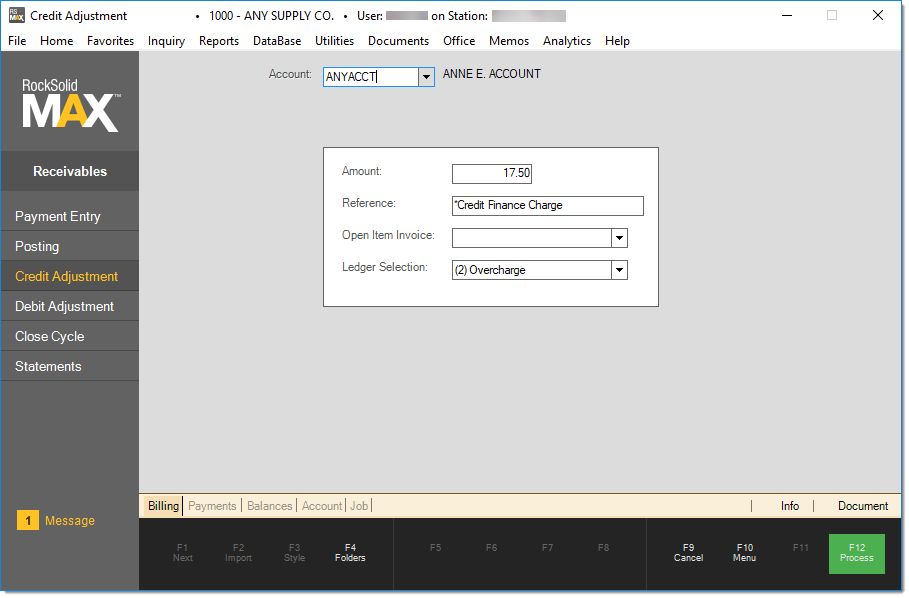

Begin by selecting the customer's account. If you don't know the account number, use the alternate menu selections to search by name, address, etc. Enter the amount of the adjustment. The "reference" is just a text description of the credit adjustment. It will print on the customer's statement, so it's a good idea to fill this in. To link the credit to a specific invoice, choose the invoice using the drop down. When the credit is selected during posting, it will automatically apply to the invoice selected; however, this is only performs a function if the customer is "open item." Balance forward accounts don't pay by invoice, so an invoice link is meaningless.

The final input, ledger selection, is used to choose an offset to the credit adjustment being made to your company's receivables. When making a any adjustment to receivables, general ledger must be affected. Every general ledger transaction has a credit and debit side that must equal. The "ledger selection" is the debit side of the entry and offsets the "credit" to receivables. It's possible to map various offsets for either credit or debit adjustments. This is done in General Ledger, Database, and Detailed Mapping.

Once all the information is entered and is correct, use the Process (F12) function to save the credit adjustment on the customer's account. The credit adjustment will then appear in the customer's list of open credits during the Posting process where it may be applied to the customer's balance or list of open items (when applicable).